House prices in Kent – what is the market doing right now?

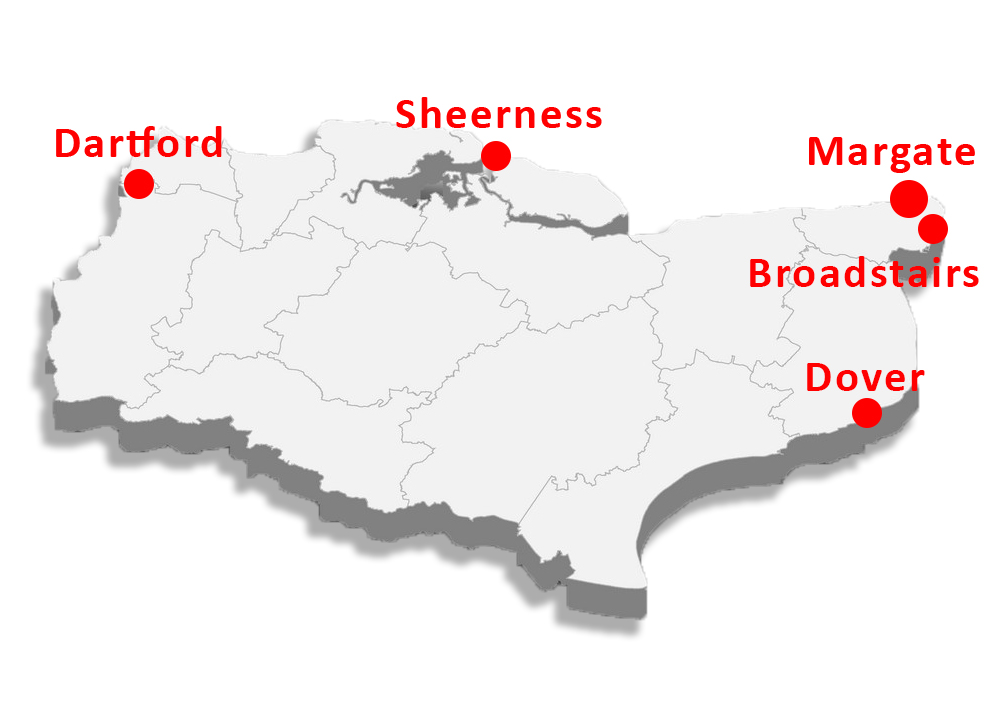

Everyone is aware by now that house prices in the UK have been rising at a rapid rate in recent months and indeed for several years (excluding the early stages of the pandemic). However, six popular towns in Kent have seen amongst the highest sustained rises in the UK over the last decade. According to recent data from Rightmove, Margate is at the top of the list, with average house prices in the town more than doubling from January 2012 to January 2022. Dover, Sheerness, Dartford and Broadstairs have all recorded increases of over 90% through the same period. Walderslade wasn’t far behind with a change of just under 90%.

Kent towns it appears, have led the national trend, through a combination of infrastructure investment enabling commuting to London and local development and investment projects encouraging tourism, such as the Turner Gallery in Margate.

We believe this trend will continue, as more people look to commute to London to work. We also believe these house price rises are starting to be – and will continue to be – reflected in rents in these areas.

How do rents compare in Kent Towns?

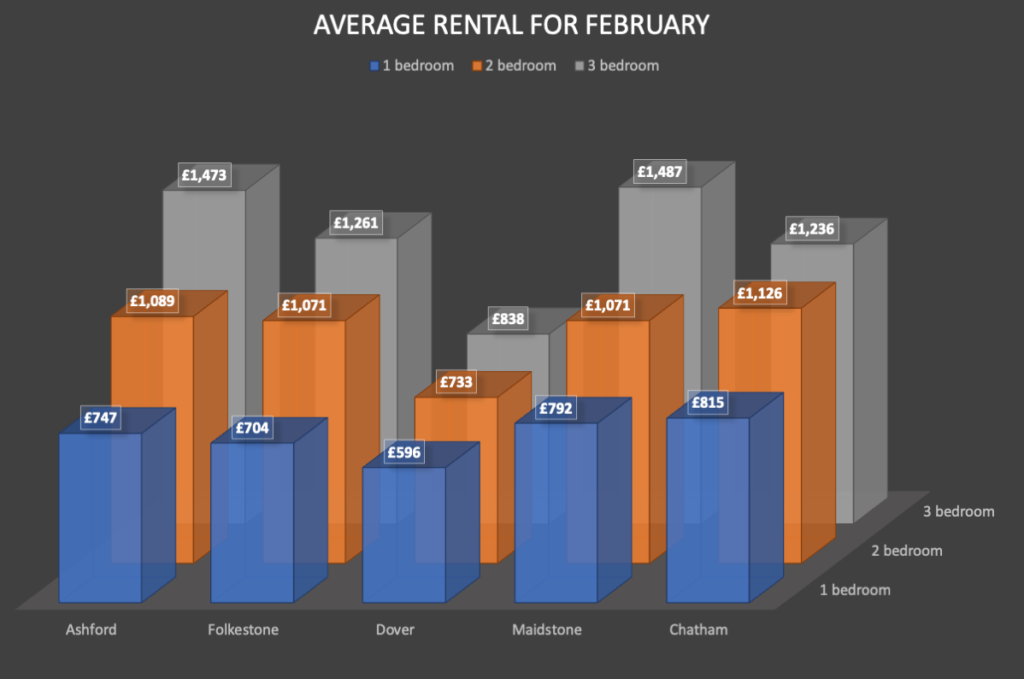

Are you currently letting your property or will you be doing so soon? Trying to decide where to invest? Whilst we can’t offer specific investment advice, we have pulled together some comparables for several well-known Kent towns that are popular with investors. The informatic below compares average rents for February for one, two and three bed properties (flats or houses) across Ashford, Folkestone, Dover, Maidstone and Chatham.

Ashford leads the pack in terms of rents for 2 and 3 bedroom properties, but rents for 1 bedroom properties are softer, perhaps reflecting the good supply of 1 bedroom flats in the town.

Investment decisions are about more than just rent received of course. We would encourage you to look at property price and yield in these towns. In addition, as an investor you will need to consider net income too, which will be driven by lettability/voids, running costs etc.

We will try to bring you more data in our coming newsletters throughout the year.